Credit card reconciliation on auto pilot

PivotEQ reconciles in the background. You're free to go.Credit Card Reconciliation

TODAY vs TOMORROW

Still Using All This to Make Reconciliation Happen?

Spreadsheets, calculators, credit card statements, and expense reports

plus chasing employees who are late with their reports.

We’re sorry this happens.

How About Just Sitting Back and Watching it Happen?

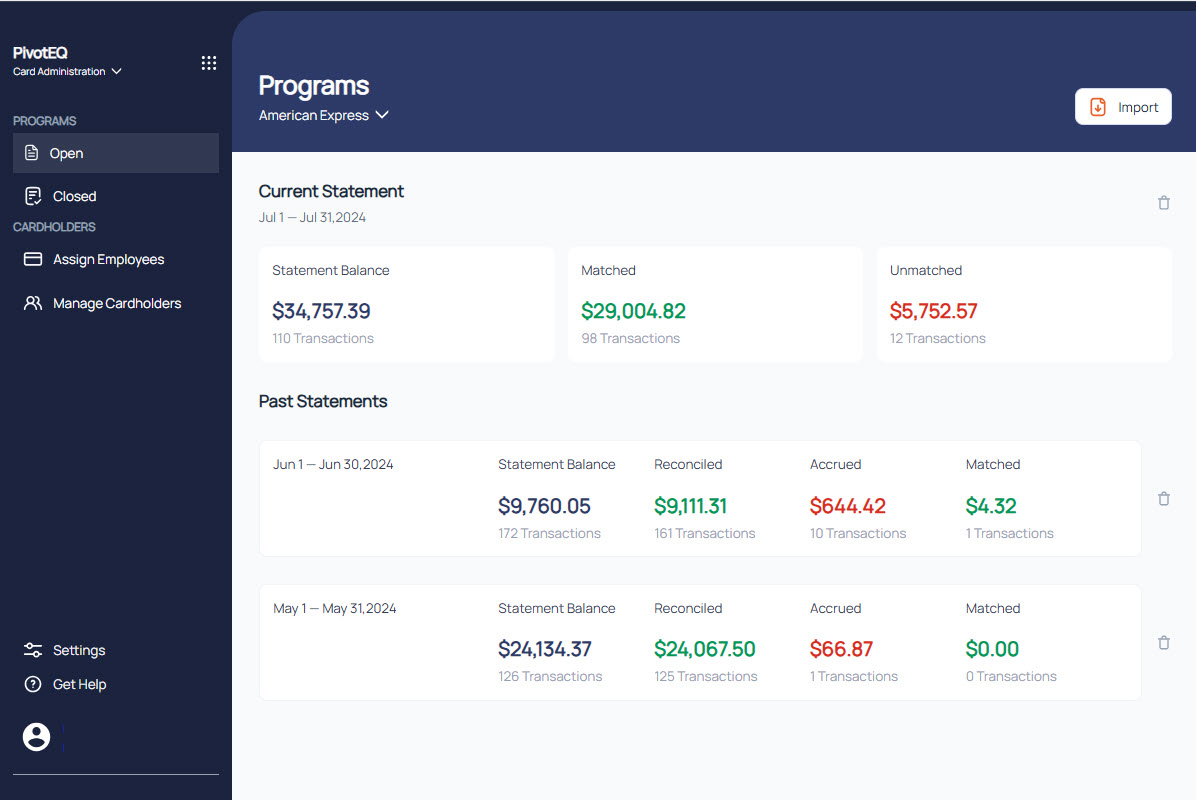

Set reconciliation to autopilot. PivotEQ compares credit card statements to expense reports in real time, automatically —24/7.

We can make this happen!

Our guess? Your process takes days. PivotEQ reconciles in the background.

Run the Calculator | Why Guess?

Chasing Cardholders Asking for Expense Reports?

You need the credit card transactions on expense reports. The chase is on!

Yeah, that happens.

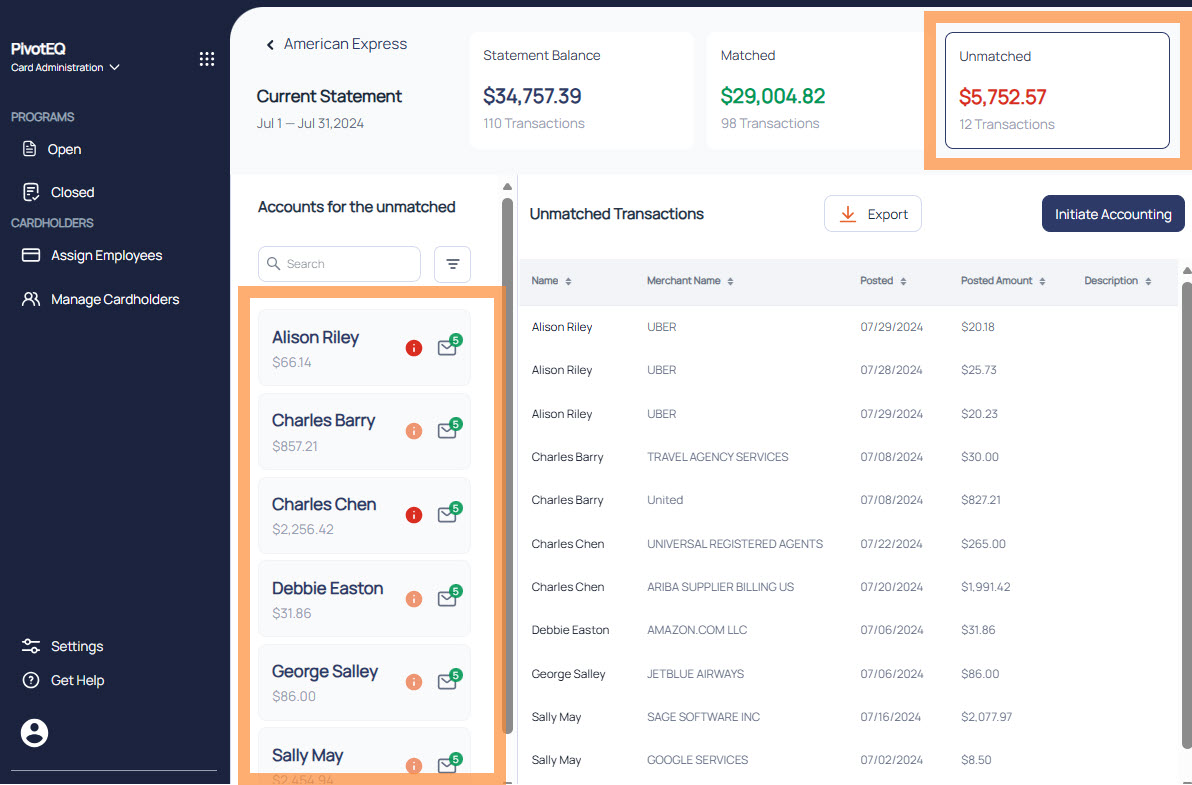

Take the Chase Off Your Plate

Unmatched transactions result in automated reminders to cardholders.

Thanks PivotEQ!

Is Your Month-End Accrual List Too Long?

You chased down expense reports… but still have piles of accruals.

Are you posting one lump sum to your ERP under Uncategorized Expenses?

That does not have to happen.

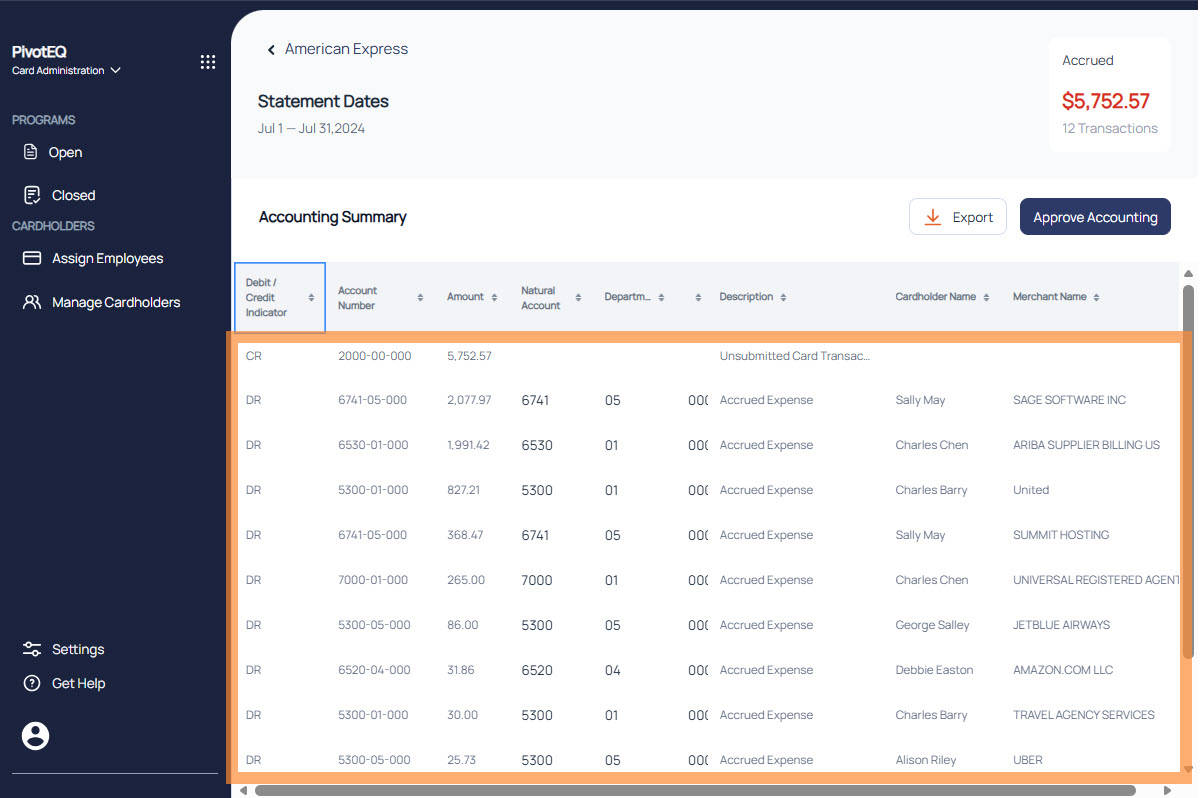

Let PivotEQ Create the Journal Entries

PivotEQ predicts the natural account code, creates an ERP-ready file, and automatically creates a correcting entry once the expense report arrives.

PivotEQ happens to be on roll!