virtual Cards = Permission vs Forgiveness

Move Spending Control to the Front of the Line with PivotLynxPivot Payables & American Express Team Up

Pivot Payables is participating in the American Express Sync™ Commercial Partner Program to offer PivotLynx for American Express® virtual Cards. The integration offers U.S. Business and Corporate Card Members the ability to generate virtual Cards within PivotLynx – Pivot Payables’ accounting automation application – ensuring requests are routed to managers for budget approval and cost accounting and virtual Card spending controls are individually applied. At statement closing, PivotLynx automates the reconciliation between the card statement and the general ledger. To generate American Express virtual Cards through Pivot Payables, you must be an American Express Corporate or American Express Business Card Member. Separate enrollment with Pivot Payables and American Express is required to utilize the combined product offering. Separate fees may apply with Pivot Payables.

Virtues of virtual Cards

PivotLynx for American Express virtual Cards replaces the traditional checks and balances that happen after the purchase in favor of a request and approval process ahead of the spender ever receiving a virtual Card.

- Establish specific controls for each on-demand virtual Card payment, including setting spending limits or expiration dates, and changing controls or deactivating on-demand virtual Cards at any time.

- Help manage budgets specific to projects and maintain visibility and control over spending with spending limits and expiration dates.

- Establish specific controls for each on-demand virtual Card payment, including spending limits, expiration dates and allowed merchant categories.

- Access virtual Card transaction data within the PivotLynx platform, reducing manual processes and improving reconciliation.

Before – Traditional Spend Control Tactics

- Limit the number of employees who receive cards

- Employees without cards must involve others for purchases

- Employees use own cards & company misses out on total spend benefits & rewards

- One credit card used for everything – all purchases

- Spending is explained after the fact

- Incorrect accounting common as employees set wrong account codes on expense reports – corrected later as an exception and sometimes go unnoticed

After – Controls Built In Prior to Issuing virtual Cards

- Managers grant virtual Cards to all who need them

- Employee requests for virtual Cards are routed for approval

- virtual Cards may be granted to external folks such as sub-contractors

- One virtual Card for each intended use such as purpose, project, or department.

- Spending approved prior to use including purpose, approved merchants, amount, date range

- Correct accounting ensured as determined ahead of issuing the virtual Card

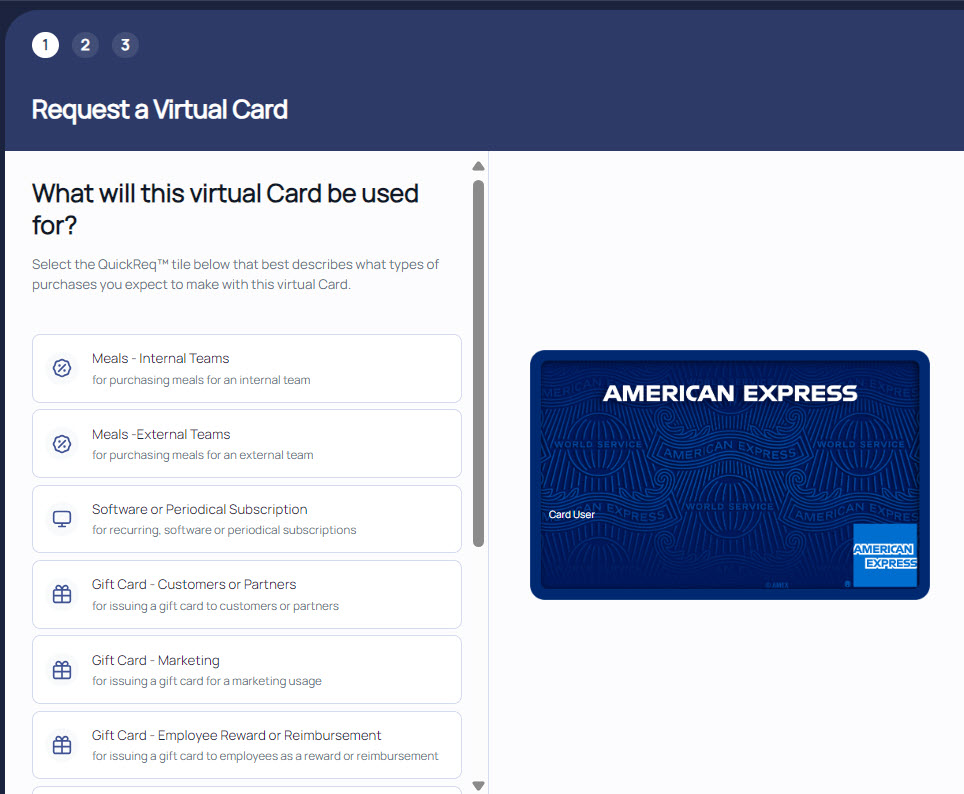

Pre-Spend Requests Start with PivotLynx QuickReq™

FOR ILLUSTRATION PURPOSES ONLY

About the PivotLynx QuickReq™

Card users will request virtual Cards for approval. For example, to attend a conference, request funding for air travel, lodging, ground transportation, conference fees, and meals.

PivotLynx QuickReqs are pre-configured request templates for a variety of virtual Card uses. Employees may choose from a list of QuickReqs appropriate for their department, business unit, or cost center. Requests are routed to the appropriate manager. Approved virtual Cards are ready for use instantly within the policies of their use such as date range.

Approvals

Managers review requests to verify funding is within budget. They also ensure the accounting is correctly associated to the applicable business units, business activities or projects, accounting period and GL accounts

PivotLynx facilitates spend control within the virtual Card parameters itself, such as:

- Set an effective date range for when the virtual Card is valid for use

- Restrict use to a specific Merchant or Merchant Category

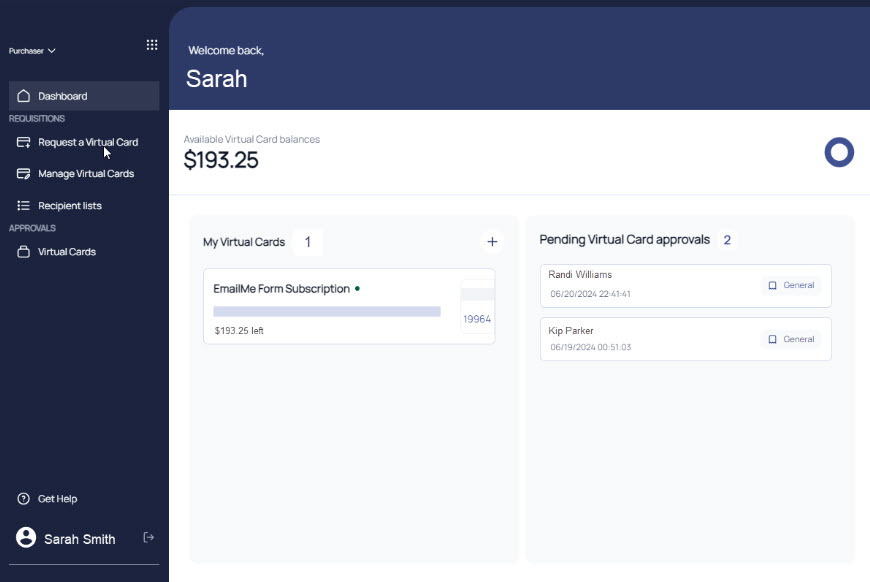

Next Stop – Approvals

FOR ILLUSTRATION PURPOSES ONLY

My virtual Cards

FOR ILLUSTRATION PURPOSES ONLY

Using a virtual Card

Card users receive an email that their virtual Card has been issued and is ready for use.

American Express virtual Cards can be used anywhere that accepts American Express – virtual Cards may be added to a Digital Wallet or used online.

Accounting prepared and imported as purchases are made.

- Expense Transactions

- SKU-Level Order Details

- Accounting Details for Each Purchase

- Receipt Images

- All into the ERP for automated reconciliation

ERP Posts Transactions & Receipts

In Only Minutes, You Accomplished All This!

- Decided who should have an American Express® virtual Card, including both internal and external recipients

- Specified the purpose for each virtual Card

- Set the allowable amount for each virtual Card

- Determined which merchants or merchant categories for purchases

- Set the date range for use

- Built in assurance the accounting is correct ahead of one penny spent

- Issued the virtual Cards

- Eliminated the possibility that Card User would accidently make a personal purchase on the company Card

Relax! You’ve Earned It!

Eligible American Express Card Members using virtual Cards in PivotLynx can:

- Establish specific controls for each on-demand virtual Card payment, including setting spending limits or expiration dates, and changing controls or deactivating on-demand virtual Cards at any time.

- Help manage budgets specific to projects and maintain visibility and control over spending with spending limits and expiration dates.

- Establish specific controls for each on-demand virtual Card payment, including spending limits, expiration dates and allowed merchant categories.

- Access virtual Card transaction data within the PivotLynx platform, reducing manual processes and improving reconciliation.

To generate American Express virtual Cards through Pivot Payables, you must be an American Express Corporate, American Express Business, or American Express Corporate Purchasing Card Member. Separate enrollment with Pivot Payables and American Express is required to utilize combined product offering. To make an American Express Card payment to a vendor through Pivot Payables, the vendor must be an American Express accepting merchant. There is no fee to generate American Express virtual Cards. Certain features, upgrades, and additional payment methods may require separate activations and fees may apply. Pivot Payables is solely responsible for determining any and all fees associated with their product. Please contact your Pivot Payables representative to learn more.

We have teamed up with American Express to give our customers access to the control, added security, and cash flow management that come with using an American Express® virtual Card, alongside the PivotLynx application. The integration helps us provide an elevated user experience and more value to our customers.

John Toman

Chief Product Officer & Co-Founder

Pivot Payables

Real American Express Card Member aware that this testimonial may be featured in marketing materials.